Introduction

In the world of construction and contracting, establishing trust and credibility is paramount. One way to achieve this is through contractor bond insurance. Clients often require reassurance that the projects they are investing in will be completed satisfactorily and according to specifications. This article aims to guide you on how to effectively communicate your need for a bond to clients, helping you build stronger relationships while ensuring compliance with industry standards.

Understanding Contractor Bond Insurance

What is Contractor Bond Insurance?

Contractor bond insurance is a type of surety bond that provides financial protection to clients against potential losses due to a contractor's failure to fulfill contractual obligations. This can include everything from non-completion of a project to substandard work.

Types of Contractor Bonds

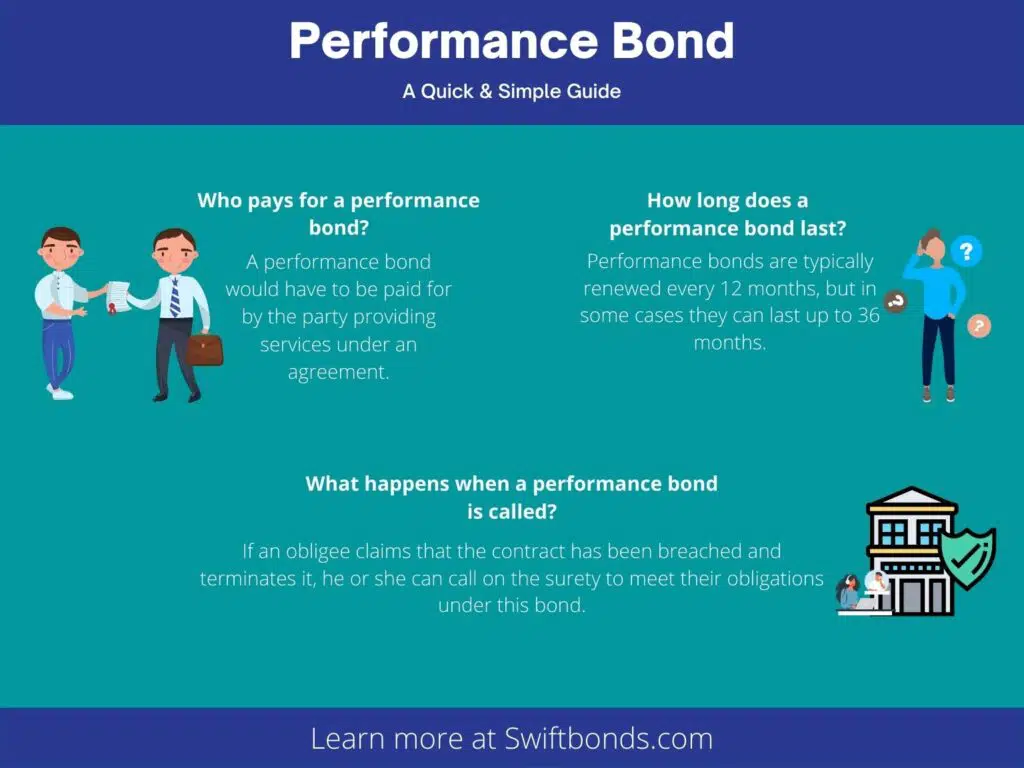

License Bonds: Required by governmental entities before a contractor can operate legally. Performance Bonds: Ensure that the contractor completes the project as per the contract. Payment Bonds: Guarantee that contractors pay their subcontractors and suppliers.Why Do Clients Require Bonds?

Clients require bonds for several reasons:

- Financial Security: Assures clients their investment is protected. Risk Management: Reduces the risk associated with hiring contractors. Professionalism: Demonstrates that contractors are serious and credible.

The Importance of Communication in Contracting

Building Trust Through Transparency

When discussing contractor bond insurance, transparency is key. Communicating clearly about why bonds are necessary helps foster trust between you and your clients.

Tailoring Your Message

Every client has unique concerns. Tailoring your message based on their specific needs can make all the difference in how well they understand and accept your request for a bond.

How to Effectively Communicate Your Need for a Bond to Clients

1. Start with Education

Begin the conversation by educating your clients about what a contractor bond is. Use simple language and avoid jargon so they can understand its significance easily.

Example Script:

"Have you heard about contractor bond insurance? It’s basically our way of ensuring that your project will be completed on time and at the quality you've been promised."

2. Explain Benefits Clearly

Highlight the advantages of having a contractor bond:

- Financial security against incomplete work Assurance of quality Protection against potential legal issues

List:

- Protection: Safeguards both parties involved. Peace of Mind: Gives clients confidence in their investment.

3. Use Real-Life Examples

Share case studies or anecdotes where bonds have saved clients from financial loss or legal complications.

Anecdote:

"I once worked on a project where unforeseen circumstances caused delays, but because we had a performance bond, our client was fully compensated."

4. Invite Questions

Encourage clients to ask questions about any aspects they don’t understand yet.

Question Prompt:

"What concerns do you have regarding bonding? I’m here to provide clarity."

Addressing Common Client Concerns about Contractor Bonds

Cost-related Concerns

Clients may worry about the additional costs associated with bonding.

Response Strategy:

Explain how these costs are minimal compared to potential financial losses due to non-completion or poor quality work.

Trust Issues with Contractors

Some clients might not trust contractors due to past experiences.

Building Credibility:

Provide testimonials from previous satisfied clients who benefited from having bonds in place.

Best Practices for Communicating about Bonds

1. Be Proactive in Conversations

Don’t wait for clients to ask about bonds; bring it up early in discussions.

2. Follow Up After Initial Discussions

Send an email summarizing key points discussed regarding bonding, reinforcing its importance.

The Role of Marketing in Communicating Bond Needs

Using Your Website Effectively

Make sure your website includes information about contractor bonds—what they are and why they're important.

| Section | Content Type | |----------------|----------------------| | FAQ | General inquiries | | Blog Posts | In-depth articles | | Testimonials | Client experiences |

Social Media Engagement

Engage with potential clients on social media platforms by sharing informative content related to bonding requirements in contracting projects.

Creating Informative Materials for Clients

Brochures and Flyers

Develop easy-to-read brochures outlining what bonds entail, including benefits and FAQs.

Video Explainers

Consider creating short videos explaining contractor bonds visually, which can be more engaging than text alone.

Overcoming Objections Related to Bonding Requirements

Anticipate Pushback

Clients may resist bonding requirements initially; being prepared with counterarguments can help alleviate concerns effectively:

Counterpoint Example:

"If you're concerned about costs, remember that having a bond could save you from potential losses down the line."

FAQ Section

1. What happens if my contractor doesn't complete the job?

If your contractor fails to complete the job, the performance bond ensures that you’ll receive compensation for any financial losses incurred due to this breach of contract.

2. How much does contractor bond insurance cost?

Costs vary depending on factors like project size and type but generally range between 0.5% - 3% of the total project value.

3. Is bonding required for every type of project?

Not all projects require bonding; however, larger projects typically do as part of risk management practices by stakeholders involved.

4. Can I negotiate terms related to bonding?

Yes! You can discuss terms with your contractors; ensure both parties have clarity on what’s expected regarding bonding requirements upfront.

5. Are there different types of surety bonds available?

Absolutely! The most common types include performance bonds, payment bonds, license bonds among others tailored specifically for different situations within contracting work!

6. What documentation do I need for securing a bond?

Generally speaking, you'll need financial statements, business licenses, credit reports along with references showcasing past successful projects undertaken successfully!

Conclusion

Effectively communicating your need for a bond not only establishes trust but also protects both parties involved in any contractual agreement within construction projects—ultimately leading towards smoother operations down-the-line! By understanding what contractor bond insurance entails along with making efforts towards open dialogues surrounding it—you'll find yourselves better equipped when navigating client conversations professionaly!

Incorporating these strategies into your communication efforts will enhance client understanding while fostering confidence in their choice—making it clear why acquiring such protections isn't just beneficial—it’s essential!

This comprehensive guide provides insights into how you can convey crucial information regarding contractor bonds effectively while addressing client concerns along-the-way seamlessly!